Week 6

Money personality research

Updated compass

Explanation of my project concept:

Wire frame of base app components

Feedback:

The

Hoarder

Hoarders hold onto every last penny that comes into their

possession. What’s most important to them is security – and money makes them

feel secure in themselves and their future. But no matter how much money a

hoarder puts away, they’ll always hoard more.

There’s a constant fear of making one wrong move and losing

it all – so they make buying decisions very slowly. Hoarders have a few common

behaviours that make them stand out from other money personalities such as:

- · Sneaking snack foods and drinks into movie cinemas or stage shows

- · Regularly reviewing your bank account to see how much money you’ve managed to put away

- · Always being on the look-out for the next bargain

- · Wherever possible, buying the best value (cheapest) products possible Hoarders can improve their financial future by loosening the reins a little bit every now and then. They need to learn to take some risks with their money in order to grow your capital faster.

The

Spender

Feeling important because you can afford to buy things is

what motivates spenders to splash their cash. Spenders feel loved, validated

and happy when they are buying new things for themselves or others. The biggest

spenders often seek out large purchases to signify their important and wealthy

status amongst their friends. Spenders are easily spotted by:

- · Excessive quantities of clothing

- · Cupboards stuffed with appliances and knick knacks

- · Big showy gifts for friends at parties

- · Large houses and new cars

- · Multiple credit cards

Spenders need to set boundaries for how much they spend.

Having a clear budget and sticking to it will help them manage their money

better.

The

Avoider

See no evil, hear no evil. That’s the approach of the

avoider when it comes to managing their money. They have no idea how much is in

their bank account and avoid talking about money with friends or family. Here’s

how to spot an avoider:

- · They avoid discussing money

- · Piles of bills waiting to be paid

- · Rarely checks bills or invoices for errors

- · Pays bills late

If you avoid making decisions about money, you’ll need to

change how you think about it. Start taking courses on how to manage your money

and map out a budget so you know how much you should be spending each month.

The Money Monk

Money is the root of all evil – that’s what the money monk

thinks. It’s a strong belief that is usually reinforced through religious

faiths or political convictions. Here’s how a money monk behaves:

- · Shy away from raises

- · Avoid dealing with finances because you think it interferes with your moral values

- · Regularly donate extra cash to charities

- · Perform volunteer work frequently

- · Always give small change to the homeless and street performers

Money doesn’t have to be bad, after all, you use it to put a

roof over your head and feed your family. To reduce the interference of money

on your moral values create as many automatic processes to manage your money

for you.

FREEDOM

SEEKER

Freedom seekers use money to buy time. They value

experiences – travel or the ability to

pour their passion into something they love. It's important for young freedom

seekers to be aware of their tendency to live in the moment so they don't

disregard their future selves. The most successful freedom seekers have self

control, and focus on achieving their goals. For some it's a lifelong focus on

getting more time through generating financial freedom. And of course, old

freedom seekers never change, they just find new horizons!

Experience is everything for our freedom seeker. Which is a

good thing for them, as research tells us that spending money on experiences

makes us happier than buying possessions.

SECURITY SAVERS same as hoarder

Money is a way to feel safe for the security saver. It gives

them a sense of control. They may be cautious about any investment they

perceive as risky and younger security savers may be working hard to be in a

position to buy their first home.

They'll probably spend more money on creating a nurturing home

environment than they do on socialising away from home - because home is at the

heart of the security saver's world. Security savers need to be careful they

don't miss out on experiences in the present because they are too concerned

about saving for the future. Being secure isn't just about being clever with

your savings – it means being clever with the way you spend your money too.

SOCIABLE SHARERS same as spender

The sociable sharer uses money as a way of showing they care

about someone. These are the people you want as your best friend. Always up for

a party or inviting you over for dinner - willing to lend you money if you need

it. sociable sharers are likely to have a separate 'mental account' which means

they can rationalise spending money on others even if it means they miss out

somewhere themselves. They may splash out more than they can afford on social

activities - going out to dinner or buying presents - because for them spending

money on other people is a way to make and maintain relationships. Spending

time with family or friends will probably be more appealing to them than a

shopping expedition.

POWER SPENDERS

If you're a power spender you react to money in a very

immediate way. Maybe it's the thrill of buying something new that you respond

to. Maybe it's the confidence that comes from knowing you're driving the right

car to make a good impression. Perhaps it's just a sense that you deserve to be

able to treat yourself.

Power spenders tend to operate at the 'spender' end of the

spectrum although when in 'saver' mode they may be the ones prepared to make

riskier investments for higher returns. Sometimes this fearlessness about risk

- and willingness to start over again if it all goes wrong - can make them

wealthy.

Power spenders also need to be aware of what is known as

hedonic adaptation - when the thrill wears off each new purchase as you get

used to it and you want to move on to the next thing to keep your mood up.

Novelty is great and makes us happy - but it doesn't always need to come with a

price tag!

Pop culture examples:

Bullet points of habits and behaviours

Updated compass

Explanation of my project concept:

Ive created a new budgeting technique I like to call

intuitive or conscious spending. The ISP (intuitive spending plan) is based off

the concept of intuitive eating recommended by nutritionists. Budgeting is

often compared to dieting, going cold turkey and hard and fast may see drastic

results in the beginning but soon fails as you feel deprived and like your

making sacrifices everyday. This is not a sustainable lifestyle in the long

run. Intuitive eating is when a person eats when they feel hungry but not

starving and stops when they’re satisfied and full but not bloated and food

baby level. Its about listening to your body and its needs, while eating a well

balanced diet this is the key to sustaining a healthy lifestyle. I have adopted

this idea of listening to your body to improve financial wellbeing by asking

the user to really dive into their passions and joys in life. Its about developing

self awareness of spending habits and listening to your mind body and soul and

asking yourself what you really value in life and what makes you happy. Does

spending $50 at kmart on a new drink bottle make you happy or are you using it

to impress your friends? Conscious spending allows you to discover what we

really value and we can identify what we’re spending on things that don’t bring

us joy and use that wasted money on things we do enjoy and prioritise

those. Why spend money on things we

don’t need with money we don’t have to impress people we don’t like? It’s the

marie condo of spending. Its fun without the guilt. The word Budgeting comes

with bad connotations, feelings of deprivation and sacrifice come to mind just

like dieting. Instead I call it a spending plan where the focus is not on money

its on goals and enjoyment. Its focusing on the positive instead of the

negative. Focusing on what you enjoy in life and what goals you want to achieve

instead of focusing on the things you cant afford and have to cut out makes it

much more useful and enjoyable and more likely to stick to it because its

easier to visualise the future benefits. This plan encourages you to start slow

with one or two goals in mind and not cutting things out completely just altering

a bad habit here and there like buying uber eats once a week instead of 3 times

because its takes time to build up confidence and comfortability with a change

in lifestyle. After all this is not a crash diet this is a lifestyle choice

that will have a lasting impact for the rest of your life. Over time, you will

be so self aware of everything you enjoy in life and everything you don’t,

money is your tool to live the life you want so youll learn how to use it

wisely and not to waste it on poor financial decisions. It’s a lifestyle

transformation, transforming beliefs, behaviour and attitudes about money and

budgeting that’s easily adaptable to all the situations life throws at you.

Its not reinventing the wheel, its taking all the positive

aspects of existing budgeting strategies and removing all the negatives to

create the ultimate financial lifestyle the key to sustaining healthy financial

habits. planning for the future and achieving long term goals will come

naturally to the user because they are thinking about what they want in life

including future plans. Don’t worry we wont let you run wild like a kid in a

candy shop, we will make sure you still get the gentle guidance needed to live

a sustainable and secure life because that is our goal , to help you live the

life you want whether your 18 or 80.

Instead of money being the enemy, money is the strategy.

Using money as a tool to achieve the life you want and to do the things you

want to do.

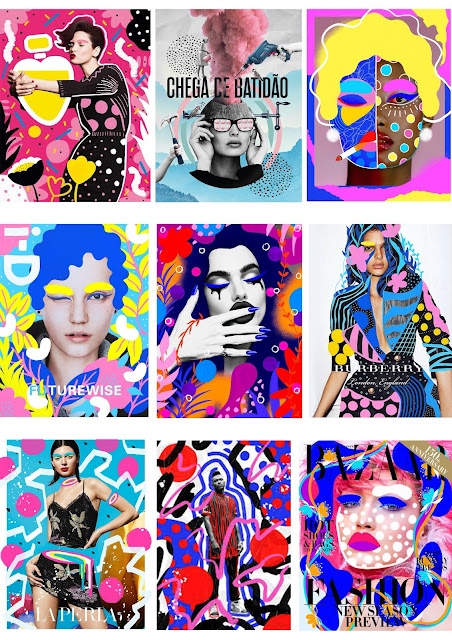

Mood board style ideas

Instagram Advertising

Feedback:

- Love the guilty confession tone of voice, carry this through more of the app

- make Instagram ads moving animations 4 seconds, more punchy and wow factor

- like Netflix art, could change 'packagining' to suit different audiences

- Dont make finance scary, slow lead into serious stuff by putting all the fun stuff first

- mockup the app store

- love the support group, community feel

- Get a brand name

- sell the it's me factor

- show each phase of the consumer journey

- the natural friendly tone of voice is good

- audience will respond to relatable things their age but trust the serious stuff to people of authority and power

- Develop persuasion theory more

- Keep the attitude in the brand

- live chat feature could be a hit or miss

- its better to have fewer features done well

- create more of a narrative

Super crit was really helpful in concept testing and validating the features I had included in my design. It was great to hear what features really stood out and what could be left out. I got some advice to work on the narrative a bit more and plan my behaviour intervention in phases of how the user would come across it and use the app. When I come back from the break, I will have a user journey of all the phases and touchpoints needed to make a behaviour change. I'm thinking of having Instagram ads which I could make into short animation which then leads to the app store and then to the app. Within the app itself, I will also make sure all the fun, easy stuff is first as a slow introduction into the more serious, helpful side. I will work on the tone of voice because my app needs to have a bit of attitude to get the user interested and once they’ve done all the fun stuff, the serious financial help will have a more authoritative and supportive, serious tone to show trustworthiness. I will also think of a brand name for my app because it's important to sell the brand image and talk about my project in the present.

Overall super crit as a whole was very intense. The 10 minutes with our chosen tutor was the most valuable but it was also good to see everyone getting involved and giving their own feedback to projects when we weren’t seeing our tutor. Sometimes it got a little hard to tell what the whole project was about because people didn’t have all the elements of their design response out to be viewed. This made it a little confusing to give feedback because the full context wasn’t there. It would have been easier if everyone had their compass out to see the context and plan for their project ideas.

Comments

Post a Comment